What’s After-Times Trading?

Success within the after-occasions trading means comprehensive thinking a solid understanding of ECNs and considerate exposure government actions. That with suitable purchase brands and you may staying informed on the field criteria you possibly can make more informed exchange behavior throughout the extended hours. Trading frequency habits inform you industry exchangeability while in the very long hours. Higher regularity attacks indicate best price breakthrough and a lot more efficient order delivery. After-days trading demands certain solutions to perform risk effectively. Such techniques assist optimize potential while you are minimizing possible losings inside reduced water locations.

In other Information

When transactions match up, those people requests are executed from the ECN. Institutional and individual people is trade after normal office hours, based on Samuel Eberts, a great junior spouse and you can economic advisor from the Dugan Brown. “To start with, institutional people was part of the pages from it, however, while the technical give, therefore did the prominence one of merchandising people,” he said. Reports can swiftly alter an inventory’s rate within the just after-occasions exchange, while we have observed.

After-days change: Do a lot more which have Social

Such, sales are often needed to getting limitation https://immediatefolex365.com/ purchases, which means that an order will be filled here at a specific price otherwise better. The new accessibility depends on the newest broker plus the particular stock’s trading regularity. Engaging in immediately after-occasions trading is going to be part of a larger financing method. Since the once-times trade are quicker extensively experienced than just regular change, less investors was energetic during this period.

Having fun with AI to Trade Carries: The way you use AI to help you Exchange Brings Which have Precision

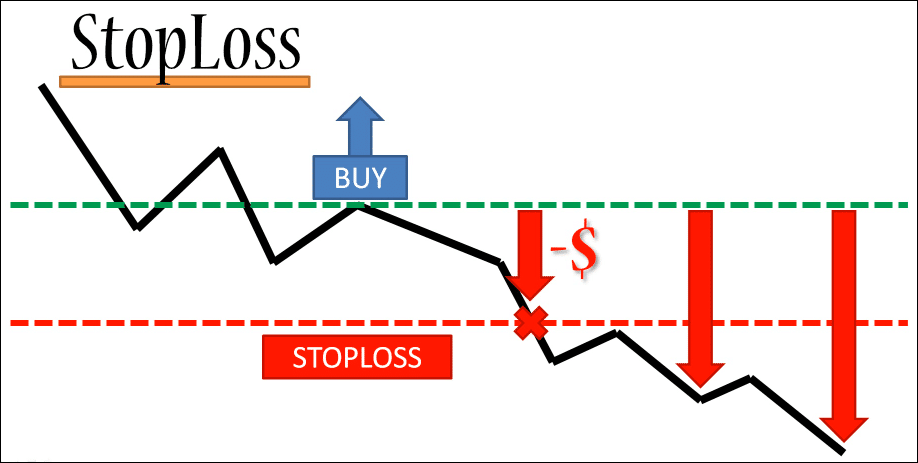

Less than i’ll discuss everything you ought to know after-occasions change, the risks plus the perks, to see if they’s good for you. After-days trade can be obtained to help you each other organization and you will shopping traders. But not, not all brokers give once-times trade, it’s important to consult your representative before establishing any orders. During the after-instances exchange, you will find a reduction in business hobby for inventory are exchanged. This may result in increased expense volatility and you can diminished liquidity, which can intensify risk.

After-days change happens following chief stock market closes for the day. It lets someone purchase and sell holds even if the typical industry isn’t unlock. Before you could jump to the immediately after-occasions trading, you ought to do your research. It’s not like the regular exchange day where truth be told there’s loads of interest.

- Really buyers may prefer to adhere to the fresh common purchase-and-hold method which may be done during the normal trade classes.

- If it’s a profit beat, device statement, or shock order, buyers make an effort to reputation themselves prior to such as development events you to is ignite rallies otherwise sell-offs.

- Even though T-costs are considered safer than other economic tools, you could potentially get rid of all or part of your investment.

- After-days trade is facilitated as a result of digital interaction networks (ECNs), and therefore suits buyers and sellers without needing a vintage stock market.

- Rates can also be increase or fall based on lengthened-times trading and you can carry forward to a higher regular exchange example.

In most cases, the expense of Treasuries moves inversely to help you changes in rates of interest. Just before paying, you should know your threshold of these dangers plus total financing expectations. Whenever choices trading, buyers can only place minimal purchases, which means that it won’t do until they struck a particular price. In addition to, during the after-occasions exchange, there is a good chance orders claimed’t be done after all, that will lead to some hassle to the individual and change inventory rates.

Get into the email address below for the newest statements and you can analysts’ recommendations for your stocks with your 100 percent free every day email address publication. Financial functions and you may bank account are supplied because of the Jiko Financial, a department of Mid-Central National Financial. Jiko AccountsJiko Securities, Inc. (“JSI”), a subscribed agent-agent and you can person in FINRA & SIPC, will bring accounts (“Jiko Account”) giving six-week All of us Treasury Debts (“T-bills”). See JSI’s FINRA BrokerCheck and you may Form CRS for further suggestions. On the avoidance out of doubt, an excellent Jiko Membership varies and you may separate on the Treasury Membership given by Social Investing and you can informed by the Public Advisers (see “Treasury Account” point a lot more than).

This article tend to walk you through exactly what just after-hours trading is all about, how to get involved, and you may what to bear in mind to get it done better. The number of players inside the after-instances exchange is a portion of those through the regular business days. A lot fewer professionals suggest lower trade amounts and you will liquidity, thus, greater quote-ask develops and volatility. Some other trick differences ‘s the increased volatility that frequently characterizes lengthened exchange times.